Leading technology analyst firm Transforma Insights unveils its key ‘Transition Topics’ that will shape the Internet of Things landscape during 2025.

Every year Transforma Insights publishes its list of IoT ‘Transition Topics’ highlighting where we expect to see seismic change occurring during the year. This year the list focuses on the application of Artificial Intelligence to IoT, the shift towards 5G, changing commercial dynamics and the growing impact of IoT regulations.

The Transition Topics will form the basis of a significant part of the research agenda for the Transforma Insights Advisory Service in 2025, as well as sponsored Position Papers and Virtual Briefings.

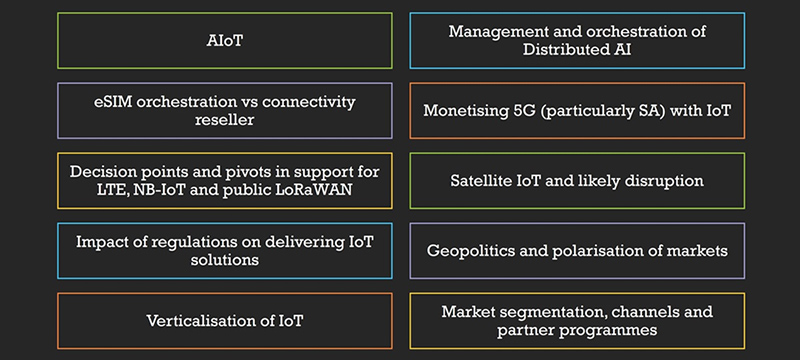

Transition Topics for 2025

For the coming year we have defined a set of Transition Topics encompassing both new areas and evolutions of some themes explored in previous years. The topics will be:

1. AIoT

It is impossible to overstate the extent of interest in the application of Artificial Intelligence in all kinds of technology environments. One critical area considers the implementation of AI onboard IoT devices. Augmenting IoT with AI can significantly enhance a device value proposition and many businesses are incorporating built-in AI functionalities within their hardware device portfolios to enhance product functionalities and create value added services. We expect the adoption of AI onboard IoT devices to accelerate quickly with significant implications for product roadmap, application architecture and market dynamics. As well as analysing the qualitative impact on the market, Transforma Insights will continue its work quantifying the AIoT market opportunity.

2. Management and orchestration of distributed AI

Supporting the implementation of AI applications onboard IoT devices, there is an increasingly critical function in handling the maintenance and updating of those applications and the orchestration of compute workloads and storage related to AI, between the edge device, campus edge, network edge, and cloud. We will consider the opportunity presented by AI orchestration and the new capabilities and architectures needed to support distributed AI.

3. eSIM orchestration vs connectivity reseller

The imminent arrival of the SGP.32 ‘IoT’ standard for remote SIM provisioning in 2025 promises to trigger a new phase in the provision of IoT connectivity and in the associated roles. Specifically, we expect to see the role of IoT connectivity provider (MNO/MVNO) fragment into three main roles: network operator, reseller and a new role of eSIM orchestrator, handling profile management and potentially integrating with a role of single-pane-of-glass (SPOG) connectivity abstraction platform. We will consider the implications for the market structure and competitive dynamics for IoT connectivity providers and their customers.

4. Monetising 5G (and particularly 5G SA) with IoT

The focus of many Mobile Network Operators will be squarely on how to monetise their investments in 5G and we will examine the ways in which IoT represents an opportunity to do so. Our focus will be on identifying the likely revenue opportunities that might accrue to a MNOs from 5G services delivered over public networks, and particularly those related to 5G Stand Alone (SA) beyond regular handsets and data services. This includes consideration of higher bandwidth capabilities, ultra-low latency, increased reliability, network slicing, network exposure functions, APIs and more.

5. Decision points and pivots in support for LTE, NB-IoT and public LoRaWAN

Alongside the arrival of 5G we expect some critical decisions and pivotal changes in 2025 about the fate of other public network technologies. MNOs will increasingly turn their attention to timelines for LTE switch-off and will probably take more decisive action to reflect their ambivalence towards other public network technologies including NB-IoT. We will also consider the future of public LoRaWAN. The prevailing trend is favouring a return to piggybacking on existing networks deployed for conventional mobile services rather than the use of dedicated public network technologies for IoT.

6. Satellite IoT and likely disruption

NTN, or Non-Terrestrial Networks, were one of the most talked about emerging technologies of 2024, combining the potential for satellite and cellular connectivity both into a single package. In 2025 the rubber will hit the road, or perhaps not. We will unpick the extent to which emerging NTN propositions will either augment or cannibalise existing cellular markets. We will also focus on how pure-play either satellite or cellular operators can best respond to the emerging threats, such as they are.

7. Impact of regulations on delivering IoT solutions

Regulatory compliance was our number one Transition Topic for IoT in 2024 and it will continue to be critical in 2025. The last few years have seen substantial developments in regulations for security, permanent roaming, data sovereignty, national resilience and data management, including the EU’s Data Act and Cyber Resilience Act, the UK’s PSTI Act, and numerous developments in the US. This is one of the reasons Transforma Insights provides its Regulatory Database, to help vendors and adopters navigate their way through the increasingly complex regulatory landscape. In particular, in 2025 we will focus on the ways in which IoT solutions (and the underlying services that support them) will need to be provisioned to address the greater regulatory burden.

8. Geopolitics and polarisation of markets

One extension on the theme of regulation relates to the specific growing challenge of geopolitics. With increasing tensions over supply chains and software bills of materials (SBOMs), regulations such as the EU’s NIS2 Directive and the UK Procurement Act, and increasing friction in the US for Chinese vendors, we expect a greater polarisation of IoT markets. We will explore the implications for topics such as hardware and vendor selection and auditability/ traceability.

9. Verticalisation of IoT

All IoT is vertical. Few companies deploying IoT think of themselves as doing IoT; instead they are deploying smart grid, fleet management, building automation and a plethora of other such use cases. In that environment, the prevailing horizontal approach from vendors will come under increasing pressure. We expect to see greater success for vertical specialists and those vendors able to contextualise their horizontal proposition for a vertical audience and develop an appropriate go-to-market with vertical-specific requirements and buying behaviour at its core.

10. Market segmentation, channels and partner programmes

With IoT vendors facing continuing pressure on margins, it is becoming ever more pressing to optimise sales strategies. Effective market segmentation is critical, in order to identify target customers. So too is a refined approach to channels, distributors, resellers and partner programmes.

The post Transforma Insights announces IoT Transition Topics for 2025 appeared first on IoT Business News.