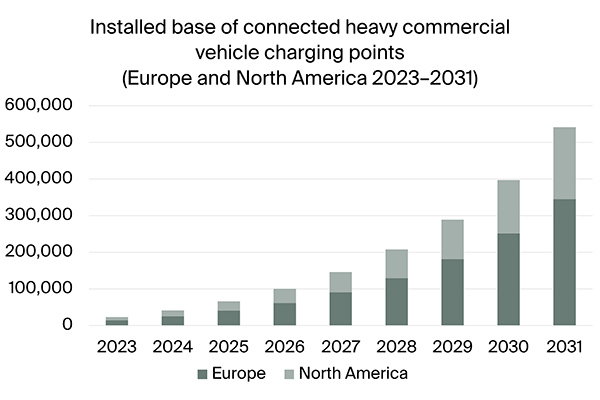

Berg Insight just released new findings about the market for heavy electric commercial vehicle charging infrastructure in Europe and North America.

The total number of connected charging points in Europe is forecasted to grow at a compound annual growth rate (CAGR) of 49 percent from 14,000 in 2023 to 345,000 by the end of 2031. In North America, Berg Insight estimates that the total number of connected charging points will increase from 9,000 in 2023 to reach 196,000 by 2031, growing at a CAGR of 47 percent. These numbers include both public and non-public charging points. Mega-challenges such as vehicle emissions and climate change continue to encourage investments in electric commercial vehicles and charging infrastructure, contributing to a positive outlook for the market.

The commercial vehicle charging market is served by a variety of players such as specialised and non-specialised electric commercial vehicle OEMs, charge point operators (CPOs), charging equipment manufacturers and software providers. The market for commercial vehicle charging is still in its very early stages in both Europe and North America. Several notable CPOs have initiated commercial-scale projects while others are still in the pilot phase. Circle K, BP Pulse and Milence are among the actors that have opened charging stations for heavy commercial vehicles in Europe.

In North America, Greenlane, Forum Mobility and TeraWatt Infrastructure develop charging networks for heavy-duty electric vehicles. In North America, a number of regional and international companies market DC chargers for commercial vehicle charging. ChargePoint is a leading full-service provider on the market offering hardware, software and CPO services. Other major hardware providers offering DC charging stations in the region include ABB E-mobility, BTC Power (E.ON), Tritium, SK Signet, Delta Electronics, BorgWarner, Detroit Diesel, FreeWire, Kempower and Siemens.

The European DC charging market is more fragmented. Alpitronic has emerged as a leading supplier of DC charging hardware and additional prominent actors include ABB E-mobility, EVBox, Kempower, Ekoenergetyka, Siemens, Heliox (Siemens), i-charging, SBRS (Shell), Efacec, Tritium and ADS-TEC Energy. Several software-specific providers in both regions offer charging station management solutions such as fleet management tools, peak shaving, smart charging and booking solutions. Examples of software-specific actors include Last Mile Solutions, Virta, GreenFlux, Driivz, AMPECO and Noodoe.

“Connectivity is crucial for managing the charging process effectively and a vital part of the charging infrastructure for both public and non-public charging”, said Caspar Jansson, Senior Analyst at Berg Insight. This capability enables businesses and charging station operators to have real-time insights into the charging status, availability and performance of charging points.

“Although still relatively nascent, the EV charging industry has reached a stage of maturity that creates space for integrating complementary technologies, reflecting a growing need for solutions that enhance resource efficiency, scalability and the user experience”, added Mr. Jansson.

Connectivity enables providers of complementary services to seamlessly integrate their solutions into the value chain to improve the use case for various stakeholders. Software-enabled connectivity allows for the implementation of advanced load management techniques, demand response solutions, energy storage solutions, renewable energy integration, battery health monitoring solutions and tools to support fleet electrification.

Mr. Jansson, concluded:

“These solutions, improve resource efficiency by increasing the usable capacity of charging installations and electric fleets. Controlling and managing the power draw prevents grid overloading while energy storage solutions and renewable energy integration can increase the peak capacity of a site to allow for more traffic. Tools to support fleet operators in creating a successful electrification strategy and battery health monitoring systems further help reduce teething issues with new drive train technology and keep operational levels high.”

The post The number of connected heavy commercial vehicle charging points in Europe and North America to reach 541,000 by 2031 appeared first on IoT Business News.