Asian stock markets are trading mixed on Friday, balancing positive cues from Wall Street overnight with concerns about a potential global trade war and its impact on inflation.

US President Donald Trump’s decision to delay implementing a reciprocal tariff plan provided some reassurance to investors.

Japanese market snaps winning streak

In Japan, the market reversed its recent winning streak despite positive cues from Wall Street.

The Nikkei 225 Index dropped 174.17 points or 0.44%, closing the morning session at 39,287.30 after hitting a high of 39,543.93 earlier in the day.

Weakness in technology and financial stocks weighed on the index.

Market heavyweight SoftBank Group gained nearly 2%, but Fast Retailing fell more than 1%.

In the automotive sector, Toyota edged down 0.3%, while Honda surged nearly 4%.

Technology stocks also faced losses, with Advantest down 0.5%, Tokyo Electron declining almost 2%, and Screen Holdings dropping nearly 1%.

Hong Kong stocks extend rally

Hong Kong stocks continued their upward momentum, setting the stage for their longest weekly winning streak in two years.

The Hang Seng Index surged 2.24% to 22,303.80, marking a 5.6% gain for the week and its fifth straight weekly advance.

The Hang Seng Tech Index jumped 3.2%, driven by enthusiasm around Beijing’s stimulus measures and the DeepSeek trend, which has fueled gains in Chinese technology stocks.

Mainland Chinese markets posted modest gains, with the CSI 300 Index rising 0.8% and the Shanghai Composite Index adding 0.1%.

Major Hong Kong-listed Chinese tech firms such as Alibaba, Tencent, and Meituan were among the top gainers, further lifting investor sentiment.

Other regional markets

The Australian stock market is trading notably higher, extending its gains to a fourth consecutive session.

The benchmark S&P/ASX 200 Index climbed 41.40 points or 0.49% to 8,581.40, just below its all-time high of 8,615.20 reached earlier in the day.

South Korea’s Kospi looked set to extend its gains for the fourth straight session on Friday. The index was up 0.56% to trade at 2,597.63.

Wall Street ends higher on Thursday

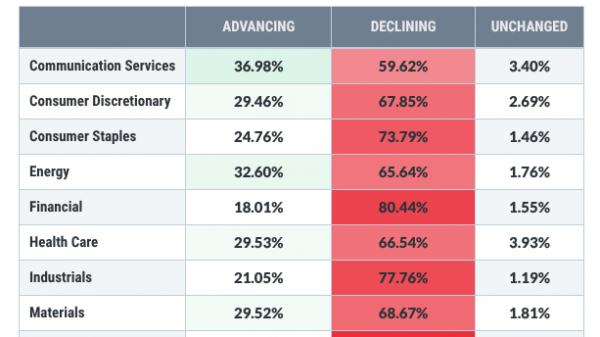

US stocks rallied sharply on Thursday, continuing the rebound from Wednesday’s early session sell-off.

All major indices posted strong gains, with the Nasdaq outperforming.

The Nasdaq surged 295.69 points, or 1.5%, to close at 19,945.64. The S&P 500 climbed 63.10 points, or 1.0%, to 6,115.07, while the Dow rose 342.87 points, or 0.8%, to finish at 44,711.43.

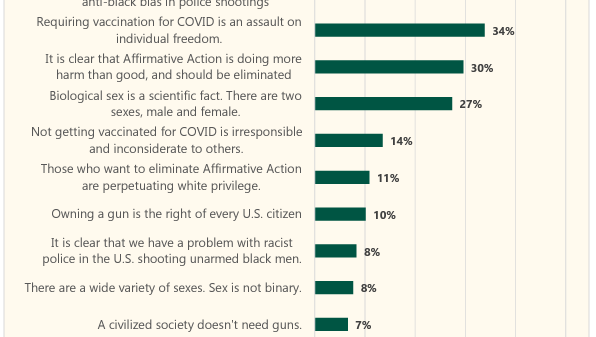

The market rally was fueled by the release of the Labor Department’s report on producer price inflation for January.

According to the report, the producer price index for final demand increased by 0.4% in January, following a revised 0.5% rise in December.

Stocks extended their gains on Thursday after President Donald Trump signed a memorandum directing his administration to review plans for reciprocal tariffs on US trade partners.

The move signaled a shift toward addressing trade imbalances but stopped short of imposing immediate tariffs, which provided relief to market participants concerned about potential global trade war.

The post Asian markets mixed on Friday: Hang Seng outperforms with over 2% surge appeared first on Invezz