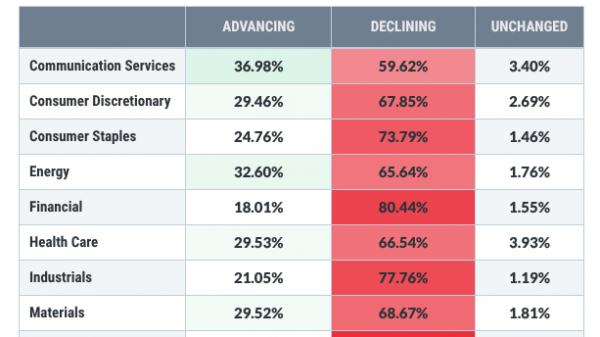

US stocks surged on Thursday as fresh inflation data and tariff policy updates helped ease investor concerns about economic pressures and global trade tensions.

The Dow Jones Industrial Average climbed 348 points, or 0.8%, while the S&P 500 and Nasdaq Composite gained 0.8% and 1.1%, respectively.

Strong performances in the technology sector, led by Nvidia, Tesla, and Arm Holdings, contributed to the rally.

Tech stocks drive market rebound

Nvidia jumped 3% after Hewlett Packard Enterprise announced it had shipped its first solution using the Blackwell chip.

AppLovin, last year’s best-performing US tech stock, soared 20% following strong earnings.

Meanwhile, Tesla gained over 4%, though its stock remains near a three-month low.

Arm Holdings spiked 8% after reports suggested the semiconductor firm plans to launch its chip later this year, potentially securing Meta as a key client.

Inflation data provides relief

Investors reacted positively to the latest Producer Price Index (PPI) report, which showed a 0.4% increase for January, slightly above the 0.3% estimate.

However, the core PPI, which excludes food and energy, matched expectations at 0.3%, helping to calm fears of persistent inflation.

Despite the hotter headline number, analysts believe the data signals a softer reading for the upcoming Personal Consumption Expenditures (PCE) price index, the Federal Reserve’s preferred inflation gauge.

This speculation pushed the 10-year Treasury yield down more than 10 basis points to 4.531%, boosting equity sentiment.

India ETF slides as trade tensions rise

The iShares MSCI India ETF declined 0.2% on Thursday, extending its weekly loss to 3.1%.

The drop coincided with Indian Prime Minister Narendra Modi’s visit to Washington, D.C., where he and President Donald Trump are set to discuss trade policies.

Trump signed an executive order on reciprocal tariffs, stating that India has more tariffs than any other country.

The US reported a $45.7 billion trade deficit with India in 2024, fueling speculation about potential policy changes that could impact US-India trade relations.

Cybersecurity firm SailPoint debuted on the Nasdaq after going private two years ago, pricing its IPO at $23 per share.

The stock’s performance will be closely watched as investors assess demand for cybersecurity offerings in a competitive landscape.

Investors are closely monitoring upcoming economic data and Federal Reserve signals, while tech stocks remain at the forefront of market momentum.

With earnings season in full swing and geopolitical developments unfolding, traders will be watching whether stocks can sustain their gains heading into next week.

The post Wall Street rallies as inflation concerns ease; Nvidia, Tesla, and Arm lead gains appeared first on Invezz