TSR Market Update: 2024 Cellular IoT Module Market

Weak demand and inventory correction continues in Western market. China market shows strong rebound. India market emerges. LTE Cat.1 bis continues to grow from China to globally.

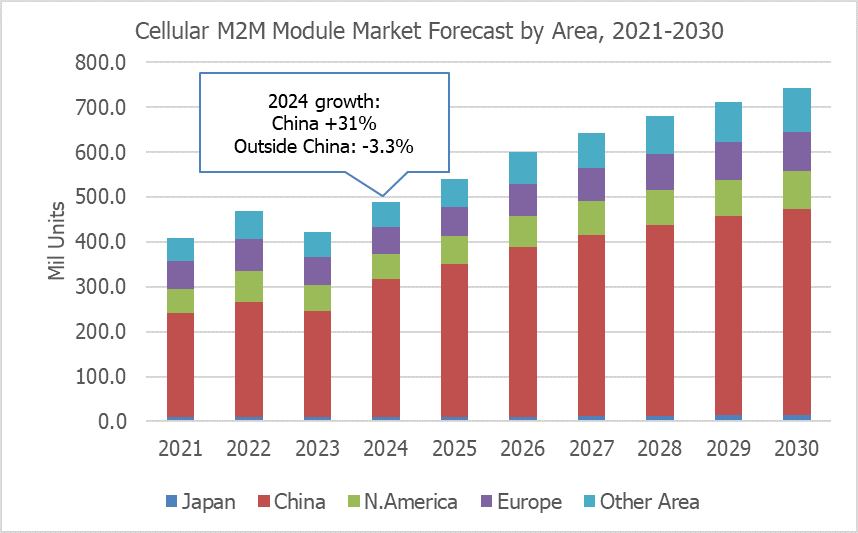

Cellular IoT Module Market Forecast by Area – The opposite trend between China and Western market in 2024

Cellular IoT module (Industrial and automotive) market is estimated to grow by 16% in 2024 thanks to the strong rebound in China and India market growth, offset the consecutive decrease in the western market. In 2025, China market is estimated to grow by 10-15% YoY. The Western market is expected to rebound from inventory adjustment in the past two years, to achieve high single-digit to around 10% YoY growth. We forecast mid-high single digit growth after 2025.

China has been the largest market for cellular IoT modules, with a share of around 55% in 2021-2023. In 2024, while outside-China market decreased, the China market has expanded, and its share has grown to 63%. Among outside-China market, North American and European market decreased consecutively from 2023 to 2024, while India market start growing for smart meter deployments, e-bike, and mobile payment.

For end-use, smart utility metering, GPS tracking (fleet, asset, life…), smart payment, car OEM telematics, and security/automation (security camera and sensor) are the main applications of cellular IoT modules. It is also used for remote medical, remote health monitoring, cold chain, smart city, smart agriculture, EV/ e-bike charging pile, PV electric generator, and so on.

Among cellular industrial applications, demand for smart gas/water metering, security camera, electric scooter tracking, EV and e-bike charging piles are growing in recent years.

Cellular IoT Module Market Forecast by Standard – LTE Cat.1 bis will be next 2G, replacing part of cellular LPWA. 4G to 5G migration will take time.

Many industrial IoT applications do not require high speed data communication, while reliable network (area coverage and stable connection) is essential.

In 2024, LTE Cat.1/Cat.1 bis is the most widely adopted, followed by LTE/LTE-Advanced, NB-IoT, and LTE Cat.M. The market share of Cellular LPWA standards (LTE Cat.M and NB-IoT) is decreasing as some of the applications like GPS tracking return to low-cost LTE Cat.1 bis (with eDRx low power technology) to take advantage of better network coverage.

The market share of broadband cellular modules (LTE/LTE-Advanced, 5G eMBB, and RedCap) is estimated to be about 24% in 2024, decreasing slightly to 22% in 2030.

The trends in industrial M2M module standards for 2023-2024 are as follows:

- Cellular LPWA (LTE Cat.M and NB-IoT) market has decreased for the second consecutive year, with its share decreasing from 27% (2023) to 21% (2024).

- LTE Cat.1/Cat.1 bis has expanded significantly, from 32% (2023) to 45% (2024).

- LTE market share has decreased slightly from 23% (2023) to 22.5% (2024).

- 5G remains niche in the industrial IoT field, but will increase for car automotive telematics from 2024.

The trends in 2025 onwards are:

- LTE Cat.1 bis market expansion outside China, replacing 2G/3G and some LPWA applications, with its share increase to around 61-62% in 2028-2030.

- 5G RedCap market to grow in China in 2026-2027 followed by the module prices drop.

- 5G eRedCap module market will take off in 2028-2029, as a successor of LTE Cat.1 bis. North America and China are expected to be the early adopter of 5G eRedCap.

- LTE Cat.M market will rebound, moderate growth from 2025, mainly in the smart metering and healthcare fields.

- NB-IoT market is shrinking in China by reverse back to LTE Cat.1 bis, while the demand remains in China gas meter, India, part of Southern Europe and part of southeast Asia.

- 5G eMBB is has been niche in industrial IoT market. Its share is expected to increase for Car OEM telematics, security cameras, robotics, AI applications, reaching 5% share by 2030.

5G RedCap Device Market Forecast – China Industrial IoT, Consumer wearable and low end MBB

5G RedCap is positioned as the successor to LTE Cat.4 and LTE Cat.6. High end Industrial, Car OEM Telematics (in China), low end mobile broadband and consumer wearable will be the main applications of 5G RedCap in next 5 years.

Commercial deployment of 5G Redcap has begun in North America, China, and the Philippines. Australia, India, and the Middle East are expected to follow in next 1-2 years. The penetration speed of 5G Redcap depends on MNOs network strategy (4G to 5G migration, 5G SA network penetration) and device cost.

In terms of device cost, there are huge price delta in 5G Redcap chipset between Chinese suppliers and Western suppliers. Currently, 5G Redcap chipset price is estimated about $20-25 in the western market, while it is already reaching below $10 in China. Chinese startup chip suppliers have aggressive price roadmap, target to make 5G RedCap chip price below $5 by 2026. 5G Redcap could widespread faster in China, Middle East, Southeast Asia, and other emerging countries, where enterprises and government accept Chinese cellular chipset.

5G eRedCap, which is a further cut-off from RedCap, is expected to be materialized in 2028. 5G eRedCap will be the successor to LTE Cat.1 bis, and may also partially replace LTE Cat.M. Since the LTE Cat.1 bis chipset is very mature and low cost, it is likely that the migration to 5G eRedCap will take long time.

Cellular Module & Modem Chip Market Share – Fragmented, but the market share concentrated to a few suppliers. Chinese suppliers gain market share

|

|

Reflecting geographical market trends, Chinese cellular module suppliers gained market share in 2024, while Western module suppliers decreased significantly. Among main module suppliers, Quectel, China Mobile-IoT (CMCC-IoT), Fibocom, Neoway, and Lierda gained market share respectively in 2024, while Telit-Cinterion, Sierra Wireless (Semtech), and u-blox lost market share due to declining demand in the western market and inventory adjustments.

The top supplier Quectel recorded 46.6% of the market share in shipment unit base, added 5.2% from the previous year. Despite increasing geopolitical concern, Quectel and Fibocom are growing market share in both China and overseas, including North America.

The main module suppliers in each region are as follows (excluding automotive):

- Japan: Telit-Cinterion, Quectel, Sierra Wireless, SunSea, TaiyoYuden, Murata, Seiko, Abit

- China: Quectel, CMCC IoT, Lierda, Fibocom, SunSea, Neoway, MeiG, MobileTek, Luat, Unionman…

- N.America: Telit-Cinterion, Quectel, Sierra Wireless, u-blox, SunSea, Fibocom

- Europe: Quectel, Telit-Cinterion, SunSea, Sierra Wireless, Fibocom

- India: Quectel, Neoway, Telit-Cinterion, Cavli, SunSea, Fibocom, MoMagic

After the massive revenue decrease in 2024, ublox decided to close the cellular module business. As the cellular module market shrunk significantly in the western countries, other module suppliers may follow the way, to retreat or exit from cellular module business.

In China market, Due to the fierce price competition, some of Chinese module suppliers, Gosuncn Welink, MeiG, Huawei, Neoway, and others shifted their focus from module business to device ODM and IoT platform business.

For the chipsets for cellular IoT modules, ASR and UNISOC gained market share in 2024 as LTE Cat.1 bis increase significantly in cellular IoT module market. While Qualcomm, Xinyi, Sony, MediaTek and other suppliers decreased. There are about 20 companies participating in the market, top 4 suppliers: Qualcomm, ASR, Eigencomm and UNISOC together will count about 87% market share in 2024, increasing from 80% in 2023.

Major chipset manufacturers by cellular standard are as follows:

- GSM: MediaTek, UNISOC

- LTE: Qualcomm, UNISOC, Sanechips, ASR, MediaTek

- 5G eMBB: Qualcomm, UNISOC, Sanechips, MediaTek (Telematics)

- 5G RedCap: HiSilicon, ASR

- LTE Cat.1 Qualcomm, Intel, Sequans

- LTE Cat.1 bis: ASR, Eigencomm, UNISOC, AICXTek, Innochip

- LTE Cat.M: Qualcomm, Sony, ublox, Nordic, Sequans

- NB-IoT: Eigencomm, Xinyi, UNISOC, HiSilicon

In the LTE Cat.1 bis chipset market, ASR has a market share of nearly 50% in 2024. Eigencomm and UNISOC share most of the remaining pie. Since 2H2023, AICX, Innochip, Xinyi, Sequans, Qualcomm and others have entered but have not succeeded yet. As LTE Cat.1 bis market will grow in North America and Japan in 2025-2026, Qualcomm is expected to take major share in these areas with new chipsets. Qualcomm first acquired the LTE IP from Eigencomm, then it acquired the LTE IP from Sequans

5G RedCap for industrial IoT is being deployed in the China market first, thus HiSilicon has acquired a majority market share by 2024. ASR, Eigencomm, and several startup companies such as Cygnus, Innobase, Innochip, and Bluewave are coming into the market in 2024-2025, market share is expected to be diversified quickly in 2025-2026.

The post 2024 Cellular IoT Module Market Update appeared first on IoT Business News.